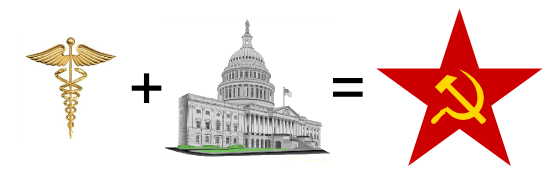

Mark my words: a public option health care plan will someday be the only plan.

Don’t put any faith in today’s democrat promises. With a few votes and a sympathetic president, future liberals can (and will) alter public option’s scope. With impunity. That is government’s track record:

- Social Security expands: At inception, a 1% tax on the first $3,000 of income funded the system. By 1940, it paid $35 million of benefits. Now it’s a 6.2% tax on the first $102,000 of income and pays $650 billion of benefits. (source)

- Income tax expands: In 1913, when the Sixteenth Amendment was ratified, the income tax was 1% of all earnings over $3,000. Now it is between 10% and 35%, depending on your bracket. (source)

- Even the Pension Benefit Guaranty Corporation expands: “When the PBGC was created in 1974, Democrats running Congress assured everyone there was no taxpayer risk because the agency would be funded by fees from pension plans, as well as by the assets of plans the company takes over.” “Now the PBGC has a $33.5 billion deficit,” and this is before it is about to take on much of Delphi’s pension, a politically-motivated, union face-saving “second biggest pension bailout in PBGC history.” (source)

- How about those automaker loans? What started in 2008 as large loans is now a giant taxpayer giveaway that just won’t end.

I could fill a whole blog post with expansionism.

Even with current democrat promises, public option probably starts out with a massive tax subsidy and forced lower payments than what private insurers can negotiate (a la Medicare). It will creep like St. Augustine grass and gradually smother all other options. Future expansionists will just seal this fate.

Don’t get me wrong: the current system is flawed. And Obama is right about a lot of its flaws. But as an expansionist liberal, anything he prescribes is quackery.